Georgia Residents Have Recovered Millions With Our Help!

Unlock Your Claim's Potential in Georgia! Serving Georgia Residents with Proven Results, Recovering Millions. Discover the Power of Our Expert Public Adjusters!

Find a Public Adjuster Near Me

Find a Public Adjuster Near Me

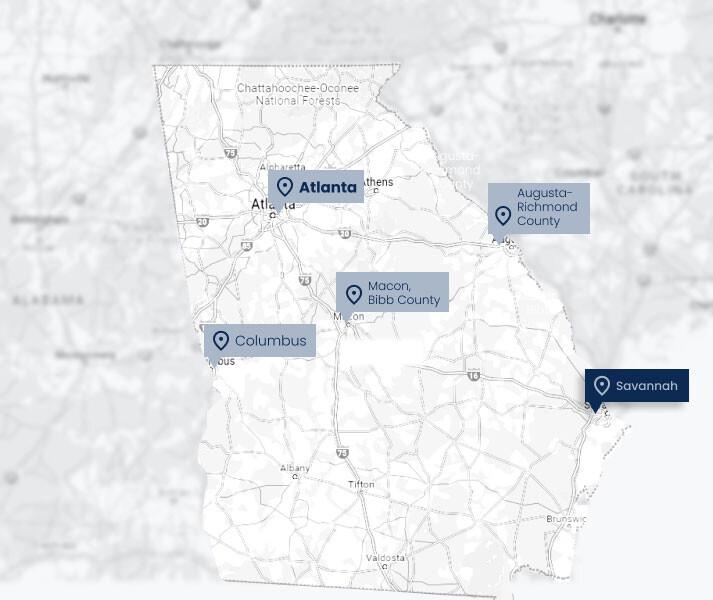

We have several offices in Georgia, but we can help you anywhere in the state. We can have someone on-site anywhere in the state within 48 hours.

Tiffany T.

Great company--does what they promise to do and got me so much more money from my insurance company than I ever imagined when the insurance company said my claim was only worth $41,000. I got over 200,000 due to Adam and Karen and the team there saying stay with us and we will get you paid. Use this company!!!!!!!!!

Capital Adjusting Services has a team of licensed public adjusters that can help with maximizing property insurance claims. Whether you want to make a claim for fire damage

Don’t fight insurance on your own. Let Capital Adjusting Services handle it. Adam was with us all the way and got us way more than we could have imagined

Lorem Joy

Don’t fight insurance on your own. Let Capital Adjusting Services handle it. Adam was with us all the way and got us way more than we could have imagined

Over 5,000+ Success Stories

Experience the difference firsthand. Contact us today for unrivaled claim expertise and exceptional results.

Important Information About Georgia Insurance Laws & Regulations

Important Information About Georgia Insurance Laws & Regulations

- Georgia law requires insurance companies to act in good faith when handling claims, ensuring prompt investigation and fair evaluation of damages. Policyholders in Georgia have the option to seek assistance from both public adjusters and private adjusters to navigate the claims process effectively.

- Public adjusters and private adjusters are licensed professionals who provide valuable expertise and assistance to policyholders in dealing with insurance claims. They work on behalf of policyholders to ensure that the insurance company properly assesses and settles the claim. Public adjusters primarily represent policyholders, while private adjusters can represent either the insurance company or the policyholder, depending on the situation.

- Homeowners insurance policies in Georgia typically cover damage caused by fire, water, hurricanes, vandalism, and other specified perils, subject to policy terms and coverage limits. Public adjusters and private adjusters can help policyholders document the damage, evaluate the claim, and negotiate a fair settlement with the insurance company, ensuring that policyholders receive the coverage they are entitled to.

- In the event of a business interruption due to damage from a covered event such as a fire, storm, or flood, business interruption insurance can help cover lost income and expenses. Both public adjusters and private adjusters can assist business owners in properly documenting and valuing their losses, maximizing their business interruption claim.

- Given Georgia’s vulnerability to severe weather events like hurricanes and tornadoes, specific deductibles or coverage limits may apply to these events in insurance policies. Public adjusters and private adjusters can provide guidance on policy details and help policyholders understand the complexities of their coverage to ensure appropriate compensation for severe weather damage.

- While homeowners insurance policies in Georgia generally do not include coverage for floods, residents in flood-prone areas should consider purchasing separate flood insurance policies. Public adjusters and private adjusters can offer advice on assessing flood risk and obtaining suitable coverage to protect against potential flood-related damages.

- The Georgia Department of Insurance oversees the insurance industry, safeguarding consumer rights and regulating insurance companies, agents, public adjusters, and private adjusters. The department ensures compliance with insurance laws and regulations, providing resources and assistance to policyholders. In case of any issues or disputes with insurance claims, policyholders can seek guidance from the department or consult with public adjusters or private adjusters for expert assistance.

Benefits of Hiring a public adjuster in Georgia

Get 663% More From Insurance Companies With Capital Adjusting Services

Expertise in Georgia insurance laws

Don't leave your insurance claim to chance. A public adjuster's expertise in Georgia insurance laws can ensure you receive the maximum compensation you deserve.

Experience with Georgia weather events

Georgia weather events can wreak havoc on your property. A public adjuster with experience handling such claims can save you time and hassle by handling the process on your behalf.

Thorough understanding of the claims process

A public adjuster's thorough understanding of the claims process can help you navigate the complex paperwork and requirements, leaving you free to focus on getting your life back to normal.

Objective evaluation of damages

Don't rely on an insurance company's assessment of damages. A public adjuster will provide an objective evaluation of damages, ensuring that you receive a fair and accurate settlement.

Save Time

Time is money, and a public adjuster can save you both. With their expertise and experience, they can handle your claim quickly and efficiently, ensuring that you receive the compensation you need as soon as possible.

About Public Adjusting In Georgia

How Does It Work?

Initial Consultation:

The first step in the public adjusting process is an initial consultation with a public adjuster. During this consultation, the public adjuster will review the details of your claim, assess the damage to your property, and discuss your insurance policy and coverage limits.

Damage Assessment:

After the initial consultation, the public adjuster will conduct a thorough inspection of the damaged property to assess the extent of the damage and gather evidence to support your claim. This may involve taking photographs, videos, and measurements of the damage, as well as reviewing any relevant documents, such as repair estimates.

Negotiation with the Insurance Company & Private Adjusters:

Once the public adjuster has gathered all the necessary information and evidence, they will prepare a detailed claim presentation to submit to your insurance company. The public adjuster will negotiate with the insurance company on your behalf to ensure that you receive a fair settlement that covers all your damages and losses.

Settlement:

If a settlement is reached with the insurance company, the public adjuster will review the settlement agreement to ensure that it accurately reflects the terms and conditions of the settlement. If you are satisfied with the settlement, the public adjuster will assist you in obtaining the settlement payment from your insurance company.

Statistics for Georgia Insurance Claims

Georgia is no stranger to natural disasters and other types of damage that can lead to insurance claims. Here are some statistics and numbers related to insurance claims in Georgia →

Don't let insurance companies take advantage of you. We have the knowledge you need to get the compensation you deserve.

FILE YOUR CLAIMLow-Balled by Your Insurance Company?

We Can Help.

Our adjusters manage water damage claims in Georgia, covering repairs, replacements, and income loss caused by floods, storms, or leaks.

Our adjusters handle fire damage claims in Georgia, ensuring you receive compensation for property repairs, replacements, and lost income.

Georgia's severe storms can damage properties. We specialize in storm damage claims, ensuring fair compensation for your losses.

We assist with hurricane damage claims in Georgia, securing settlements for property repairs, rebuilding, and income loss due to hurricanes.

Our adjusters handle vandalism damage claims in Georgia, ensuring you receive appropriate compensation for your property damages.

For business interruptions in Georgia, we handle claims to compensate for lost income and related expenses.

Mold damage in Georgia is a serious issue. We negotiate settlements to cover remediation, property damage, and lost income.

Navigating commercial property damage claims in Georgia is complex. Our experts maximize compensation for commercial losses.

We assist with flood damage claims in Georgia, securing fair settlements for property damages and losses caused by floods.

For any other property damage in Georgia, our adjusters help file claims and negotiate for maximum payouts.

File Your Claim Today With Our Licensed Public Adjuster Georgia

Maximize Your Claims, Reclaim What's Yours!

Capital Adjusting Services: Your Path to Fair Compensation!