Cities you can find us at

What Do We Do at Capital Adjusting Services

A public adjuster has been defined as “an independent insurance professional that a policyholder may hire to help settle an insurance claim on his or her behalf.” When one has damage sustained to their home and business it is without fail a stressful time. A public adjuster not only works to maximize the value of your claim but to be your resource and ensure that everything you are entitled to from the insurance company is paid but also to guide you through the process and ensure that every question and concern is promptly addressed. At Capital Adjusting Services our team of public adjusters and staff is available to ensure that your claim experience is as stress-free as possible.

Why Should You Hire a Licensed Public Adjuster in North Carolina?

Along with the peace of mind you will enjoy hiring a professional public adjuster you will also likely get a much larger payout from the insurance company. When our public adjusters prepare your claim we include everything and anything necessary to restore your home to its condition prior to the loss happening. A government study found that people who hire a public adjuster to assist in the claim process receive 774% more than those that do not. The small percentage paid only when we get your claim paid is a tiny fraction of the amount of increase one should expect when hiring a professional and licensed public adjuster.

After having a fire that destroyed our entire home, we asked others what to do and everyone said to hire a public adjuster to deal with the headache of dealing with the insurance company. It was great advice. CAPITAL ADJUSTING helped us through every step of the way and made the process so simple. The insurance company did not want to pay us for all our clothing and furniture saying it should be cleaned. Adam Schwartz fought for us and the insurance company paid for every item we claimed. I know the outcome would not have been the same without Capital on our side.

Areas of Expertise in in North Carolina

Our Locations in North Carolina

We have locations throughout North Carolina to serve you. Our public adjusters in North Carolina work hard to get the best outcome for you. We have offices in:

- Raleigh

- Wilmington

- Charlotte

Even if you are not sure whether a public adjuster can help you, there is no harm in doing a free consultation. We offer free inspections of your home. These inspections can reveal damage that may not be visible to you. During our thorough examination of your home, we will document any damages regardless of whether they are covered by your insurance policy. We will also review your insurance policies to determine if the damage is covered by your policy, and we can make recommendations for whether your home or business has adequate coverage. Of course, our friendly adjusters are always happy to answer any questions you may have. Find North Carolina insurance adjusters near you.

What Does a Public Adjuster Do?

Most people have not heard of public adjusters and may not realize how the insured can benefit from their claims help services. Common tasks public adjusters in North Carolina perform for you include:

- Inspecting the site and detailing the damage

- Evaluating your insurance policies to determine what coverage applies to your claim

- Craft a specialized strategy for supporting your claim

- Gathering evidence and documenting information

- Creating an inventory of all lost property

- Calculating the amount of your losses and recommended payout

- Closely examining your policy

- Hiring and managing contractors to do repairs

- Filling out and filing claim paperwork

- Negotiating a settlement with the insurance company

- Re-opening a denied or underpaid claim to get a better settlement if a discrepancy is found

Public adjusters work with a team to get the best outcome for you, and the most experienced adjusters know the ins and outs of the claims process, so they know just what to look for to craft a strategy that is tailored to your unique case. Unlike general contractors, public adjusters are the only professionals who are licensed to legally negotiate with an insurance company.

Our Experienced and Friendly Public Adjusters

You need a qualified and experienced public adjuster when disaster strikes. Be aware that in the wake of large-scale disasters like hurricanes, many unqualified individuals may pose as public adjusters. Be skeptical of door-to-door public adjusters in the wake of a disaster. Look for experienced public adjusters who are licensed in North Carolina.

At Capital Adjusting Services, we have the experience, qualifications, and knowledge to get you the best possible settlement for your claim. We are licensed by the North Carolina Department of Insurance, and many of our knowledgeable adjusters have past experience working for insurance companies. Our friendly team of adjusters has more than 100 years of combined experience working on a range of insurance losses. We work with a network of architects, engineers, and attorneys who are experienced with insurance claims. We have handled successfully hundreds of claims in North Carolina. We put that insider knowledge of the insurance industry to work for your claim.

Specialized Services for Your Needs

We love providing our clients with top-notch insurance adjusting, loss consulting, and appraisal services. We help people with a wide range of losses and property damage claims. Our detail-oriented public adjusters know what to look for when assisting you with a loss that may be covered by your homeowners and flood insurance policies.

We help people with any loss that may be covered by their insurance policy, but some common examples of losses we regularly help clients with include:

- Hurricanes and storms

- Kitchen fires and smoke damage

- Leaky or broken pipes

- Toilet overflows

- Appliance damage

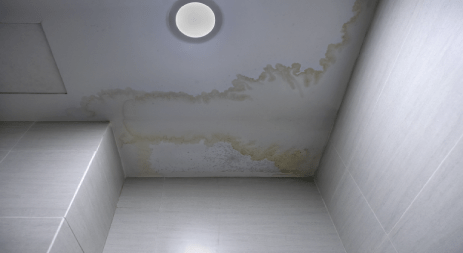

- Water damage and mold

- Roof leaks

- Vandalism

Our adjusters work to develop the best strategy for recovering your losses. Every claim is unique and requires a customized strategy. We analyze every detail of your claim on a case-by-case basis to develop the right strategy and approach. Sometimes we may need to consult with experienced professionals like architects or engineers who can help us support your claim. Whenever specialized expertise is required to recover a loss, we seek out the most qualified experts who can help us support your claim. The goal is to make the insurance company comply with the policy they sold you, so that you, the policyholder, are compensated fully according to the terms of the policy.

Can a Public Adjuster Get Me a Better Settlement?

Research has shown that people who hire a public adjuster get higher settlements from their insurance companies even when factoring in the adjuster’s fee. Public adjusters are paid a percentage of your payout. Because they get paid when you do, adjusters work hard on your behalf to get you what you are owed. Given the likelihood of a higher settlement and the relief that comes with handing over your claim to a professional, many people make the choice to hire their own insurance adjuster in North Carolina. In addition to protecting your property, a public adjuster protects your time and minimizes your stress during the claims process, which can be priceless.

An experienced public adjuster knows just what to look for. They are skilled at finding damage on your property. After a property damage claim is settled, there is nothing more frustrating than realizing that you overlooked damage on your property and have to go through the claims process again. With an adjuster, you have a better chance of submitting a claim that captures all the damage on your property. They also know how to best document the damage, so that your insurance company will have compelling proof that the damage exists and is covered by your policy. Public adjusters are insurance policy experts. They know exactly what to look for in your insurance policies to determine which policy to file a claim under, and they know how to develop the best strategy for getting you what you are owed.

What If My Claim Was Underpaid or Denied?

You deserve the maximum settlement for your claim, and it may not be too late. A public adjuster understands every step of the claims process and may be able to put together a stronger, more convincing claim that results in a higher settlement. We will thoroughly review every aspect of your claim and review your insurance policy.

Property damage can be incredibly unsettling, and the stress of a denied or underpaid claim only makes it more challenging. You may have even agreed to a low offer because you wanted the claim to come to an end, but you deserve more. It is not too late to reevaluate your claim.

Your insurance company has a team of professionals working to evaluate your claim, and you need the team at Capital Adjusting Services working to put together the best possible case for your claim. We are experienced in handling denied or underpaid claims and achieving better outcomes for our clients. Do not face the insurance company alone.